Master Your Finances: Top Tips for Thriving Financially in the Music Business

By: WhisperRoom™

October 24, 2024

Musicians who need more reliable income can fill their schedules with more gigs. However, you should also manage your money to improve fiscal stability using budgeting, investing, and future financial planning tools.

Your first step is improving one of your most important revenue sources: booking gigs.

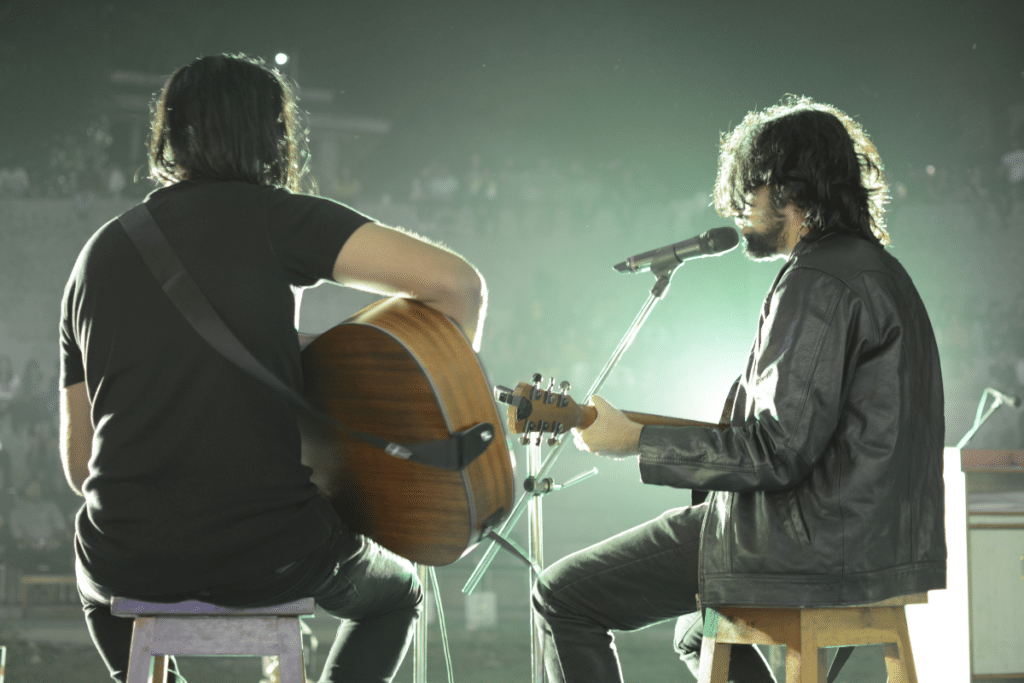

Finding and booking paying gigs is one of your steps in financially thriving in the music business. How can you get better gigs as a musician? There are a few crucial steps you need to take. First, you need live venue performance experience. Start by looking for coffee houses, restaurants, or other small venues that offer musicians opportunities. This helps you gauge audience reactions, allowing you to build setlists that engage the room.

Next, as you move up to larger spaces, set pricing for your performances. Rates will fluctuate based on your experience, location, and venue. When you book, be sure to have a contract that details all the expectations between you and the client, including communication options. When you get a booking, come fully prepared to encourage repeat bookings.

Live venues are a great foundation, but other options exist for earning income from your musical skills.

Turning your professional endeavors into a business helps you deduct expenses related to your profession from your taxes. Some of the top tax deductions for musicians include:

Turning your music into a business opportunity is not difficult. Plan for details like setting business goals, understanding your target market, planning for business finances, and developing a marketing strategy to boost your business. And, if you reinvest profits into training, you may be able to write those off as well.

Of course, many other income-earning opportunities can be part of your business.

There are many ways to diversify your income. One example is merchandising, which can also expand your brand and provide significant revenue. Both physical merchandise and digital content, like digital downloads, artwork, and online experiences, give fans more ways to support you.

Another way to make money as a musician is to become a songwriter, especially if you already craft pieces for fun or your use. Before selling any original work, register it with the Copyright Office to protect yourself from theft or plagiarism. Then, reach out to other artists and offer to write music for them. You can find people looking for these services on musician databases.

You can also get your music into TV, film, and commercials. Your composition doesn’t need to be a professional production to land these gigs; home recordings are acceptable for music supervisors in charge of selecting these songs. For these types of gigs, instrumental music is best. And if your music ends up in a successful TV series, you will earn years of residual income. Because competition is stiff, write and record pieces every week to submit music to music supervisors for licensing. Seek databases that match your musical style, such as ReverbNation or Sonicbids.

Additional revenue stream ideas include:

Hopefully, some of these ideas will expand your income. The best way to manage these earnings is with a budget.

Budgets are the easiest way to prepare for financial security. First, you must understand the budgeting basics that impact musicians. Reviewing your expenses from the past few months is especially crucial for musicians with irregular gigs and diverse income sources. If you don’t have regular paychecks, a budget keeps you within your means while building your savings.

Next, organize your expenses into necessities, like rent and utilities, and discretionary spending, such as food or instrument repair. Ideally, you should also put away around 20% of your income, but padding your savings with any amount is helpful.

Organizing your finances as a musician means setting aside funds for taxes, professional expenses, like instruments or recording equipment, and savings for your future career and retirement. Using separate business accounts for business-related bills and savings keeps your assets safe.

Financial security also means having income to cover your future goals.

Building financial stability means planning for the future. Retirement planning, including with non-traditional assets, may seem a long way off but the sooner you plan, the better you can support your musical career. These are assets outside of standard stocks and bonds and can include real estate, collectibles, physical commodities like gold, or small business investments. Some non-traditional assets, like real estate, can provide another income stream.

Investing in different financial vehicles lets you mix varied levels of risk to offset losses. Choose simple options with a short learning curve. In addition to investments, you need long-term fiscal support for professional growth and unexpected events.

As mentioned, some of your savings should be set aside. You can also set up a line of credit for emergency or professional expenses. Both are viable options, but there are some crucial differences between an emergency fund and a line of credit.

An emergency, or contingency fund, provides money for unexpected expenses, like car repairs, medical bills, home disasters, or covering bills when income is lost. Some sources recommend you save up to three to six months of living expenses.

On the other hand, a line of credit offers you more flexibility. While you can use it in times of emergency, having the ability to take out a loan allows you to fund your music profession without tapping into your savings. Approval for a line of credit depends on your credit score, income, and how much debt you have. Loans incur interest. Be sure to add this expense to your budget.

A line of credit offers better interest rates than a credit card but worse than a traditional loan. However, you only pay interest on what you borrow. A line of credit can also help build your credit rating, which helps with large-scale business or personal loans to fund your musical career.

Musicians have lots of opportunities to build financial security. You can create multiple income streams, a workable budget, and plan for retirement and emergencies. By helping you to thrive financially, these tools help you focus on building a successful musical career.

Don’t forget to share this post!